Webinars

Webinars in Fiscal Year 2021 focused mostly on the economic policy response to the COVID-19 pandemic, leveraging some of the COVID-19 work and notes of the IMF.

| Are the Remittance Flows Another Casualty of COVID-19? The Macroeconomic Consequences of Remittances: The Impact of COVID-19 (March 4, 2021) – Jointly with Joint Vienna Institute | |||

Introduction |

|||

|

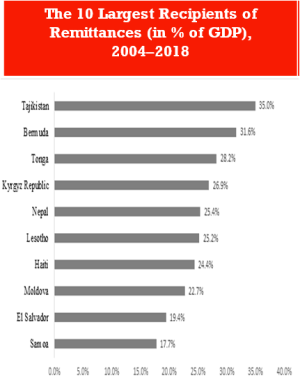

The COVID-19 pandemic has crippled the economies of rich and poor countries alike. For many low-income and fragile states, the loss of remittances—money sent home by migrant and guest workers employed in foreign countries-will exacerbate the shock. They represent a lifeline that supports households and a steady source of much-needed demand and tax revenue. As of 2018, remittance flows to fragile and vulnerable countries alone reached $350 billion, surpassing foreign direct investment, portfolio investment, and foreign aid as the single most important source of income from abroad. The webinar discussed the risks and implications of a drop in remittances on economic, fiscal, and social outcomes. The session included an interactive Q and A session with the presenters. | ||

| Debt Management Responses to the COVID-19 Pandemic (Tuesday February 16, 2021) | |||

Presenters: |

|||

|

The COVID-19 crisis presents a challenge for sovereign debt managers, as in many countries debt stresses are likely to exceed past experience across a number of dimensions, including the potential increase in financing requirements, the strain in market functioning, and a drop in external demand and capital flow reversals. The webinar discussed considerations for addressing strains where a debt manager is faced with sharply increased government financing requirements and borrowing costs, and where sound judgment is needed to distinguish between temporary dislocations and permanent changes. Within these constraints, sovereign debt managers can help cushion a liquidity shock by minimizing near-term liquidity risk, meet rollover needs and support orderly functioning of primary and secondary government bond markets. | ||

| Cybersecurity of Remote Work During the COVID-19 Pandemic (Thursday, February 4, 2021) | |

Presenters |

|

|

Given the widespread shift to working remotely for a prolonged time and the inevitable vulnerabilities in this process, new and more cyberattacks may emerge. Firms should consider implementing strong remote access security controls if they have not already done so. Similarly, if not already in place, regulatory authorities should consider issuing additional guidance, based on international technical standards The webinar also highlighted the emerging supervisory practices that contribute to effective cybersecurity risk supervision, with an emphasis on how these practices can be adopted by those agencies that are at an early stage of developing a supervisory approach to strengthen cyber resilience. |

| Financial Crisis Preparedness and Management, Jan 12, 2021 |

Presenter: |

| The financial crises of the late 1990s underscored the linkages between macroeconomic developments and financial system soundness. Weak financial institutions, inadequate regulation and supervision, and lack of transparency were at the heart of the financial crises of the late 1990s as well as the 2008 global financial crisis. That crisis also highlighted the importance of effective systemic risk monitoring and management. This is why the IMF has stepped up efforts to help countries implement policies to support sound financial systems. |

| The Central Bank’s Collateral Framework in Times of Stress (Thursday, December 3, 2020) |

Presenters: |

| The webinar discussed how a central bank could expand its collateral framework to respond to a significant tightening of financial conditions during the COVID-19 pandemic. In many economies, there has been an appreciable increase in the demand for liquidity both from financial and nonfinancial sectors in many economies. The central bank can alleviate some of this pressure through its lending operations while pursuing price and financial stability objectives. It was suggested that the central bank’s collateral framework needs to balance the requirements for extending sufficient liquidity against the risks posed to its balance sheet and the reputation that accompanies such lending. |

Webinar on Monetary and Financial Responses to the COVID-19 Pandemic for Emerging Market and Developing Economies (November, 19 2020) Presenter: |

| The COVID-19 pandemic represents a massive, unprecedented global economic and financial shock that is having a deep impact on EMDEs, with many facing acute strains from large-scale capital outflows. Given the multi-faceted nature of the shock, there is a strong rationale for deploying multiple tools. This webinar provided an overview of appropriate central bank policy responses to the severe impact of the pandemic, and IMF guidance on monetary, exchange rate, and macroprudential policies, as well as capital flow measures (CFMs). |

| Expenditure Policy Responses in Support of Workers and Households During the COVID-19 Pandemic (November 4, 2020) |

Introduction |

| The first presentation discussed the findings of the recently published paper on social spending in the MCD region, providing background on the adequacy and efficiency of education, health, and social protection spending in the region. The second presentation focused on measures introduced by countries to provide support for workers and households during the pandemic. While short-term measures have centered on protecting lives, mitigating negative income shocks, and preserving employment, countries now need to focus more on promoting a strong economic recovery and strengthening the capacity of social protection systems to protect workers and households in future crises. |

| Fiscal Risk Management During the COVID-19 Pandemic (September 29, 2020) |

Presenters |

| The webinar focused on understanding and managing fiscal risks. The COVID-19 pandemic has triggered the largest fiscal risk realization since World War II and seen governments build up fiscal risk exposures through a range of policy response measures. This webinar discussed the importance of understanding and managing these fiscal risks. It provided an overview of the IMF’s Fiscal Affairs Department’s (FAD’s) Fiscal Risk Toolkit, with particular focus on recently developed tools for assessing macro-fiscal risks related to the pandemic shock. |

Banking Regulatory and Supervisory Responses During the COVID-19 Pandemic, (July 23, 2020) |

Moderator: The webinar reviewed the banking regulatory and supervisory response to deal with the COVID-19 impact. |

| Central Bank Support to Financial Markets During the COVID-19 Pandemic (July 8, 2020) |

Moderator: This webinar focused on central bank support to financial markets and addressed global trends and IMF guidance; country practices in the region, and how the IMF / CCAMTAC can assist. |